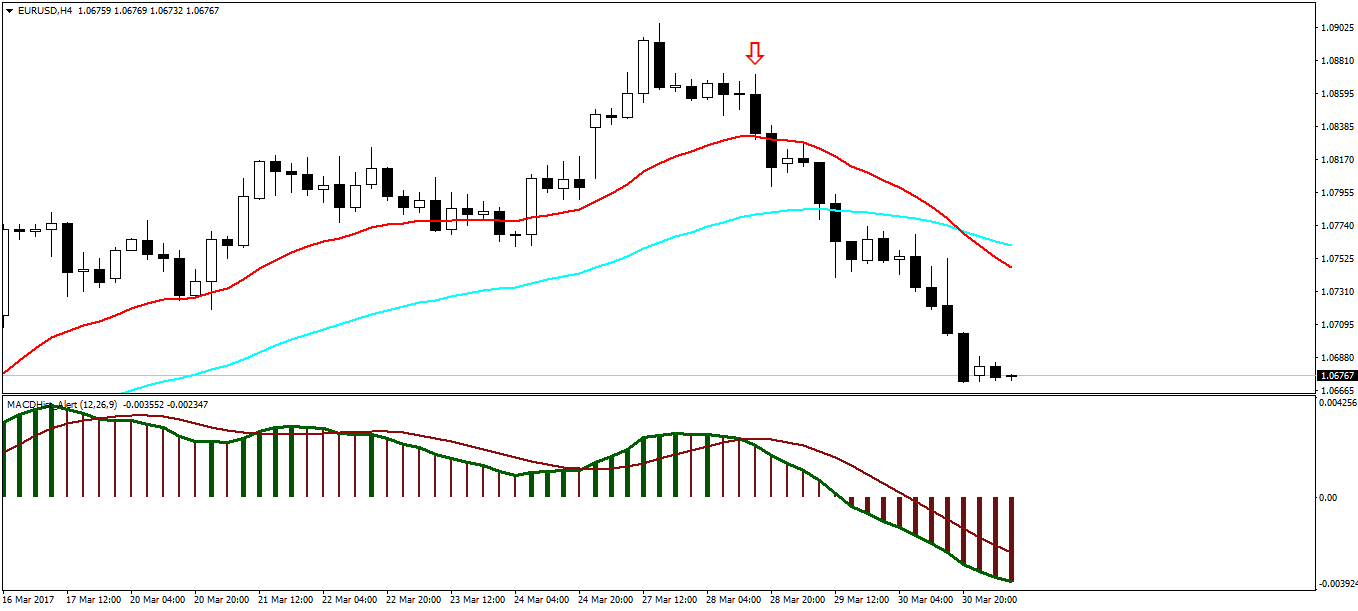

EURUSD is a great pair. It always provides me with low risk trades. Sometimes I am able to enter into a trade with a stop loss less than 10 pips. In this post I analyze a EURUSD sell trade that had a stop loss of 10 pips and take profit target of 150 pips. This gives you a Reward/Risk of 15: 1 which is excellent. Did you read the post on GBPUSD long trade with SL 10 pips and TP 250 pips? Take a look at the following screenshot. Below is the screenshot of EURUSD H4 timeframe. H4 is my favorite timeframe.

In the above screenshot, can you see the red arrow? This was the entry. I have stopped using market orders. I stopped using them a long time ago. Did you read this 15 page PDF on a Macro Level Trading Strategy? You can download this PDF FREE. I use pending limit orders.This gives em a good entry. 1.08730 was the high that was being made by the last few H4 candles. So I placed a pending sell limit order of 1.08660 and a stop loss of 1.08760. If you look at the above chart, you can see EURUSD is all poised for a big fall. So I placed a take profit target of 150 pips. This I have learned through experience. Using pending orders can help a lot in reducing the risk. Now sometimes the pending order may not get filled. Don’t worry. We get another trading opportunity soon. Just make sure that your risk is as small as possible.

You can see in the above screenshot I use MACD also in my trading. MACD is a powerful momentum indicators. When it changes color it means momentum has changed direction. In the above screenshot you can see MACD had changed color when I decided to enter the market. MACD does not help me choosing the stop loss and the take profit target. I use support/resistance levels and candlestick patterns for that. MACD only shows the momentum in the market. When MACD changes color, it means the momentum has changed. Did you read this Price Flip Trading Strategy 17 page PDF? You can download this Price Flip Trading Strategy PDF FREE.

I am working on developing an indicator that can translate my trading strategy into an automated trading system. Did you check my course MQL4 programming for traders? If you want to develop an indicator for MT4, then you should know MQL4. MQL4 language has been developed by MetaQoutes Corporation. It has been designed almost on the pattern of C++. Of course C++ is a much more powerful object oriented programming language as compared to MQL4. You can develop basic indicators and EAs using MQL4.

But if you want to use Artificial Intelligence and Machine Learning in developing your algorithmic trading system, MQL4 might not help you. Why? MQL4 lacks Artificial Intelligence and Machine Learning libraries. Developing these libraries for MQL4 can be a daunting task. So it is better to use C++ when you want to use Artificial Intelligence and Machine Learning in your trading system. C++ is a very powerful programming language. It is the language of choice of the big banks, hedge funds and other financial institutions on Wall Street.Did you read the post on how to calculate Average True Range and Keltner Channels?

Learning C++ is a big challenge. I have developed a series of 3 courses that will take you from the very start and make you an expert C++ programmer step by step.The first course is C++ For Traders. This is the basic course for those traders who have no programming experience. The second course is C++ Machine Learning For Traders. In this course, I teach you Machine Learning and Artificial Intelligence using C++. This is the second course in the series of 3 courses. Once you have mastered machine learning and artificial intelligence using C++, you are all set for the last course Algorithmic Trading With C++. This course ties what you have learned in the previous 2 courses and shows you how you are going to build your algorithmic trading strategy using C++. Many brokers provide C++ APIs for algorithmic trading. You can also write a DLL file and use C++ on MT4 and MT5.

Now as said above, risk management is the most crucial thing when it comes to trading. You should focus on risk management the most. Always make sure that you enter into the market with as small a risk as possible. Try to catch the big moves in the market with as small a risk as possible. This is what I do. I try to make 100-200 pips with a small stop loss of 10-15 pips. As said in the beginning of this post, I use pending orders. This ensures that my risk is very small. Sometimes the market doesn’t move as much as you had anticipated. In that case if you think the market is not going to move 100 pips, you can close the trade at 70 pips. Did you read this Trend Catcher Trading Strategy 24 page PDF?